What Are You Doing to Make Financial Aid More Accessible?

The Financial Aid Myths

There are plenty of myths circulating around financial aid. One is that financial aid is hard to qualify for, even if you are low income. Another is that high school students are aware of college financial aid opportunities. Yet another is that institutions will help students properly complete their financial aid applications.

First, financial aid dollars are there for the taking, but it comes with the assumption that the forms will be completed perfectly and turned in on time. Second, many students have no idea about financial aid or what they need to do to find those dollars. Third, most institutions do not have the resources to help students complete their forms or notify them if they didn’t complete their forms properly. Let’s get into the data to see the ramifications of these misconceptions.

Money, Money Everywhere

A recent article published by EdTech Times highlighted a concerning issue around financial aid: many students fail to receive financial aid not because they do not qualify but because they didn’t complete the forms properly or turn them in on time. This is an unfortunate side effect of complicated forms that come with little direction and no timeline to help students know exactly when the forms are due. It doesn’t have to be this way. We’ll get to that after we present a few sobering facts.

One of the studies the article references is from the National College Access Network. This report found half of the low-income high school graduates surveyed had not applied for financial aid simply because they were uninformed about what financial aid was. Either the students don’t understand financial aid is available or they are intimidated by the financial aid process.

To their credit, the current financial aid process isn’t simple. It’s complicated and requires a lot of information that must be inputted in an exact format and submitted within a certain timeframe. Many high schools lack the counseling to inform students of their options. Even those that do may not have the man hours available to ensure every potential qualifying student has the information they need to complete the forms as required. The complexities of financial aid applications lead us to another interesting statistic.

NerdWallet estimates $2.7 billion (yes, you read that right) in FAFSA Pell Grant funds were never allocated to students in 2016 because the applications were incomplete. With the cost of tuition rising, this is a shame. There is money to be had, yet there is little education around its availability and even less about how students need to complete the forms. Students are left to figure it out themselves, which often never happens.

It’s A Matter of Resources

If higher education institutions had the resources, they would be able to quickly identify those applications with missing or incorrect information. They would have the personnel to track down the student and/or family members to inform them of the mistakes – in plenty of time for them to make the corrections and resubmit.

Unfortunately, those resources are nowhere to be found – at least not at most colleges and universities. It can take a financial aid office months to go through all of the incoming FAFSA forms and even longer to locate each applicant to walk them through their mistakes. Oftentimes, students aren’t ever contacted, never learning that only a few missing items on their forms caused them to miss out on available dollars to help pay for their dreams.

Related: Shifting Perspectives: Financial Aid Efficiency and Compliance

These dreams are often never realized because students incur so much debt, they become discouraged and drop out. They simply cannot continue with their educational journey because the funds are not there to pay for it. Between room and board, books and living expenses, and of course, tuition, many students have no other choice but to get a job instead of pursuing graduation.

The policies and stipulations for financial aid are likely to remain constant. FAFSA is very clear about their stance on financial aid applications: “paper applications with errors or missing information will be returned for corrections; therefore, their processing will be delayed.” The length of these delays will be dependent on the institution catching the error and finding the resources to give the student notice.

Can we really deny students the opportunity to go to and complete a post-secondary education simply because there aren’t enough resources to get them through the financial aid process?

A Better Way

If we think about other areas of our lives, we can identify situations and technologies where we are instantly alerted of an issue. Take, for instance, using a gift card to make an online purchase. The website will ask for the gift card number so it can be redeemed. If even one number is mistyped, you will be notified immediately that the card was not accepted. It might even go so far as to tell you why – that the number inputted does not match their records or does not exist.

Higher learning institutions can do more to help students obtain the available FAFSA dollars that separate eager students from the degree they desire. By integrating the right technology into the FAFSA process, institutions can boost enrollment while giving students the support they need to realize their dreams.

How does it work? It’s all about automation. Automation is ideal for those repeatable, and somewhat basic information and processes. The financial aid process is just that. The forms are standard. The information is thorough but relatively basic. Identifying missing information is simple when the verification is automated. Contacting the students for missing information is sped up when the communication process is automated.

Related: Case Study: Seminole State College – Achieving Greater Success with Fewer Resources

Through automation, financial aid offices can relieve the burdens of form reviews, verifications and communications. They can free up their time to educate students about the availability of financial aid instead of going over every form with a fine tooth comb. Automation is not only faster and more efficient, but it is more apt to catch the errors and omissions. It also reduces the institution’s risk exposure when they pay for ineligible courses.

Institutions who have implemented such financial aid automation software have seen significant increases in financial aid application submissions, as well as increases in financial aid grants. Students are more informed sooner, so they have plenty of time to make corrections and resubmit before the deadline. They receive more financial aid dollars and can pay for more of their college expenses.

It isn’t rocket science. It’s taking the technology we already have and applying it to the traditionally labor-intensive process both students and financial aid offices no longer need to tolerate. The financial aid is there. It’s time to make it easier to get.

Shifting Perspectives: Financial Aid Efficiency and Compliance

The Financial Aid Grind

There’s something students and financial aid staff have in common: they both suffer from process overload. As much as students struggle to complete all of the paperwork and keep track of their course eligibility, financial aid offices are laboring over applications, disbursements, and documents in hopes of remaining compliant with the Department of Education’s requirements. It’s a continuous and exhausting treadmill of to-dos that never seems to ease.

Higher learning institutions do the best they can with the resources they have. Students try their hardest to complete their financial aid applications in time. Then, they wait. With so many applications coming in at once, it takes time to sort through them all, let alone find errors and omissions that require more input from the applicant. It can take months for the financial aid staff to recognize the missing information, track down the student to inform them and walk them through the corrections. Students can spend hours with the call center asking questions and getting help, costing the school thousands of dollars in support. Tragically, many students never get notified, understand why their application was declined or learn of their errors until after the deadline.

All of this drudgery and we haven’t even touched upon the issues with course eligibility. With many higher learning institutions, there are no safeguards to ensure financial aid students do not enroll in classes that fail to contribute to their degree requirements, thus become ineligible for financial aid. Classes are paid for without visibility into whether or not they qualify for financial aid, putting the institution at risk for noncompliance and hefty fees.

Related: New Administration, New Financial Aid Scrutiny

Many students enroll in ineligible classes because they are simply interested in the class and fail to realize the implications of taking an ineligible class. They have no degree roadmap or guided pathway to show them every class option they could take, in the order they should take them, to reach their degree requirements the fastest. Instead, they meander through the educational journey, taking longer than anticipated and racking up debt – both of which are the leading causes for dropout.

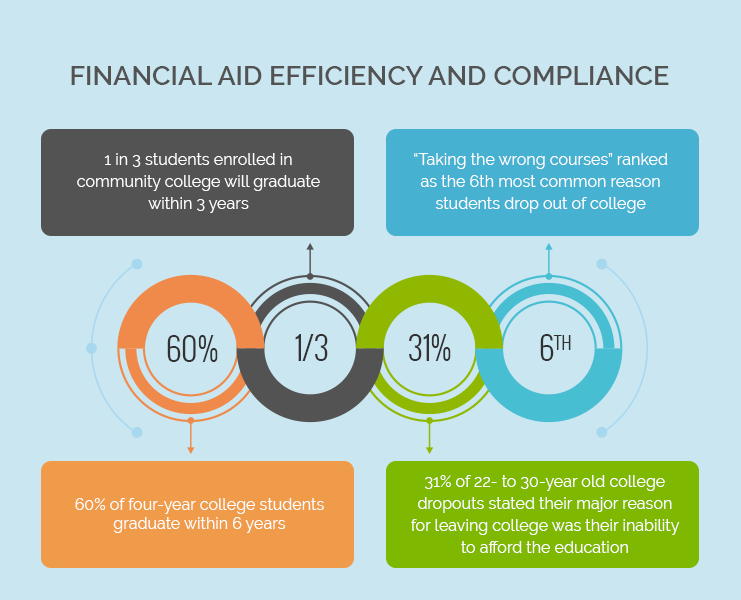

- 60% of four-year college students graduate within 6 years

- 1 in 3 students enrolled in community college will graduate within 3 years

- 31% of 22- to 30-year old college dropouts stated their major reason for leaving college was their inability to afford the education

- “Taking the wrong courses” ranked as the 6th most common reason students drop out of college

Because so many of today’s students work and have families, the financial burden of paying for their rising education costs is simply too much. In the balance of work, family and school, something eventually has to give. The harder financial aid is to manage and the more debt that is incurred, the more likely school will be the dispensable option.

Making It Easier for Students and Staff

Simplifying the application and financial aid management process would, of course, do wonders for the both the institution and the students, but how? With federal dollars and the Department of Education in the loop, it isn’t always easy to make improvements. Every application must be completed a certain way before it goes through the standard steps which require so much human interaction. Where there is repetition and standardized processes, there is always room for automation.

Automation via modern software technology is turning the financial aid process on its head. When steps can be automated, the burden of labor is lifted from staff so they can focus on other tasks. The process is faster, more fluid, and infinitely more efficient. Students and parents are empowered with sequential to-do lists, keeping them informed and organized.

Once the financial aid application is received by the institution, it is automatically uploaded into the ERP system and automatically verified for incomplete or erroneous information. The software notifies the institution if the application is complete and the student if there is something missing – within 24-hours of submission. Links to tutorials guide them on how to fix their problems themselves and complete their applications as needed.

When students have real-time access to the status of their application, they can enroll in courses with confidence, choosing only the courses they know will qualify for aid – or at least understand how their choice will impact their budget and graduation goals. Automation and access also give students the ability to map out their coursework semester-by-semester, seeing which course options would get them to their graduation goals the fastest. By taking only the eligible courses in the order they should be taken, students are more likely to stick to their plan and graduate on time and within budget.

Related: How Financial Aid Course Audit (FACA) Is Helping Students Get The Most Out of Financial Aid

Institutions can dramatically reduce their risk exposure through automation. It becomes simple, even basic, for a financial aid office to evaluate whether or not a student should be paid for a class. Ineligible classes can be flagged before students enroll. PeopleSoft, the SIS system of choice for many higher learning institutions, simply isn’t capable of performing a degree audit on every student. It takes another layer of technology to optimize PeopleSoft and automate the process.

The Marriage of Technology and Academics

Higher learning institutions have been relatively slow to break down the silos that often exist between IT and academics. Some schools are traditional and believe the programs, services and processes used in the past are sufficient for today. They are more hesitant to adopt newer technologies. This mindset, however, can be detrimental to the student and the institution.

When technology supports academic initiatives, and today’s students influence those innovations, real transformation occurs. Students are empowered to take control of their own educational journey, equipped with the information they need to stay on track and the technology required to enable them to do so. Institutions streamline processes, reduce labor and expenses, and contribute to the goal of every stakeholder – on-time graduation.

The more students who graduate on time, the more funding schools receive. The fewer dollars institutions must spend on resources to complete manual tasks, the more they can maximize that funding. Automation is the key. Without it, resources and dollars are wasted. With it, however, students and staff can do more with less.

The financial aid process doesn’t have to be so difficult. It can be, and must be, simplified and made more efficient. Students demand and deserve it. Institutions’ viability depends upon it. It requires a symbiotic relationship between academics and technology to make it happen.

New Administration, New Financial Aid Scrutiny

The Challenges for Students and Higher Learning Institutions

We’ve heard so much about President Trump’s first 100 days – what has been accomplished, what has yet to be accomplished, and new policy changes. Every U.S. president is subjected to scrutiny when it comes to this 100-day milestone. One of the hot issues for this administration comes under the education headline. The confirmation of Betsy DeVos as Education Secretary guarantees plenty of changes to many education policies, many of which are centered around financial aid.

Student loans and financial aid has always been complicated. President Obama attempted to simplify it but even after eight years in office, its complexity still looms. Everything from applying for financial aid to paying it off (or not) is equally confusing. With the new administration firmly in place, it doesn’t look like it will get much easier any time soon.

Higher learning institutions are in the crosshairs. They have increasingly more students applying for financial aid, yet the process has become so burdensome, there are still billions of federal student aid unclaimed every year. Nearly $3 billion of unclaimed federal student aid is attributed to students not filling out the required FAFSA. That totals nearly $6,000 of Pell Grant funds per high school graduate that was never claimed. To make this application process more daunting, the IRS has suspended its Data Retrieval Tool that made it somewhat easier for students to automatically pull their tax information to the FAFSA paperwork.

Another issue for students is paying off the loans they do obtain. Trump/DeVos policies may make it more difficult for defaulted borrowers to avoid high fees or be “forgiven” of their loans under certain circumstances. It may also be more complicated to manage multiple student loans because there is no centralized platform where students can repay their loans.

What It Means for Higher Learning Institutions

Higher learning institutions may not be able to do as much as they’d like to help shape the politics or policies surrounding education, but they can do plenty to help students incur less debt and ultimately be more successful as they navigate their student loans. With the cost of tuition increasing, colleges and universities must find ways to make obtaining financial aid easier. They must also go a step further to helping students stay within their financial aid requirements, enrolling in only qualified classes that are covered under financial aid.

The single best thing a higher learning institution can do to help students is to ensure better stewardship of financial aid dollars. More than ever, students cannot afford to waste a single penny of financial aid. For every dollar squandered, the student is at greater risk for dropping out of school, incurring more debt than they anticipated, and spending more years to pay off that debt than they ever imagined. With student success and student outcomes prominent themes in higher education, ensuring students can achieve their educational goals without sacrificing their economic future should be a high priority.

Making The Path Easier to Navigate

When a student decides to pursue postsecondary education, they do so with plenty of hope and big dreams. These dreams never included lifelong student loan debt or dropping out of college midway through their journey. Unfortunately, that’s exactly what happens to many students and much of it could be prevented with the use of modern technology.

Once students are approved for student loans and financial aid, the clock begins to tick. They have only a certain amount of time (usually four to six years) to use their money grant(s) before it expires. It’s not quite that easy, however. Only certain courses are eligible for the financial aid – those that fulfill specific degree requirements. Any class that has not been deemed as degree-necessary will not be paid for with financial aid, meaning students will have to pay for those classes out of pocket or take out additional loans to cover the cost.

Related: Virginia Community College Case Study

While this policy seems simple enough, it’s surprising to see so many schools struggle to make the course enrollment process transparent for students. It’s often left up to the student to determine which courses to take after researching which are eligible for financial aid. Many enroll, believing a course qualifies for financial aid, only to find out after they’ve paid for the class and purchased their books that it is ineligible. They then must begin the enrollment process all over again. It is frustrating and there are too many ways a student can make a mistake.

Technology Helps The Institution Comply and Makes The Student Journey Easier

Fortunately for both higher learning institutions and students, technology is finally answering the demand to make the student journey easier. HighPoint has spent decades building products to help students become more self-sufficient and successful. When students can access the information they need to find information quickly, perform self-service tasks instead of scheduling and attending appointments with staff, and follow their path towards their goals, they do better.

HighPoint Financial Aid Automation helps financial aid offices move the students through the financial aid process efficiently. HighPoint Financial Aid Course Auditor gives students and staff quick confirmation that the courses selected will, in fact, qualify for financial aid, in plenty of time to drop the courses and choose others that do qualify. HighPoint Roadmap presents students with the most direct route towards graduation so they’re less likely to take a costly detour.

Related: How FACA Is Helping Students Get the Most out of Financial Aid

It’s applications like these, available via mobile apps, that not only give students the information they need to succeed but give them the ability to take control of their educational journey in a way they can truly engage. They stay informed of their progress, keep tabs on their financial aid, and enroll in courses they know will be paid for by financial aid. The result? More on-time graduation, less unnecessary debt, and a better overall student experience.

What We Can Expect

With only 100 days under his belt, it is difficult to know exactly what policies will change under the Trump administration. Everyone may have their opinions, but at the end of the day, we are all just waiting to see what will happen. No matter who is in office and what policies are passed, higher learning institutions can make the financial aid process much easier for students.

The first step is giving students access to the information within PeopleSoft. When students have insight into their degree requirements, course eligibility, and road maps on the most efficient way towards reaching their goals, everyone wins. There is less burden on the institution, less risk for noncompliance, and a dozen benefits for the students.

Higher learning institutions shouldn’t be at the mercy of each new administration. They can invest in technology and programs to modernize their platform to be more responsive towards student demands. They can give students more freedom to own their own journey. They can assist students in being good stewards of the financial aid they’ve been granted. In essence, they can implement initiatives that put the students first.